How Fund and Asset Managers Can Effectively Tackle ESG Data and Reporting Challenges

Many fund and asset managers have established ESG strategies, yet translating these strategies into measurable actions remains a common challenge.

The recent release of the GRESB 2024 Real Estate Assessment Results has only highlighted the issue. Under the updated methodology, it’s no longer enough to create robust ESG processes: you need to implement them, drive results, and measure performance against your benchmarks to prove that you’re putting them into practice, too.

This shift is a valuable reminder that we’re entering a new era, in which practitioners in real estate, construction, and the property sector will only be able to unlock the value of ESG by putting their strategies into action.

In this increasingly complex environment, fund and asset managers need to ensure transparent ESG reporting, manage information across an extensive value chain, and maintain access to high-quality data. Here’s how.

3 common data challenges impacting fund and asset managers

Across the many types of clients we work with here at Catalyst—from asset managers with small, focused portfolios to those managing an extremely large number of assets and funds, as well as the construction companies delivering the work—we see the same common challenges.

1. Accessing quality data

According to a 2023 survey by BNP Paribas, inconsistent and incomplete data is the biggest barrier to ESG investing for 71% of investors. When you’re trying to demonstrate ESG performance at the asset level, it’s absolutely vital that you have high-quality, reliable data to steer your decision-making and actions—but with such complex value chains, this is often easier said than done.

2. Consolidating data spread across multiple locations and systems

It’s not just getting access to data in the first place that’s challenging: you also need to consolidate a large amount of dispersed, disconnected data to create a single, up-to-date source of truth.

Fund and asset managers work across multiple locations—physical, geographical, and technical (that is, different systems). Value chains are more extensive than ever, stretching from fund management to actual asset operations, tenants, and individual contractors working on site. Each of those players has gone through digitalisation, so they may all be using different systems and collecting data at their level.

One of the biggest challenges is making sure all of this data is not only available and accessible to you, but that you’re able to use, analyse, and implement it for your own reporting and decision-making.

3. Collaborating with different stakeholders

Internal and external stakeholders across your value chain and throughout your organisation all have varied needs and expectations—and it’s your job to manage them. For example, potential lenders, investors, joint venture partners, or insurers may have very specific requirements when it comes to your ESG reporting.

As a result, you must be able to constantly navigate between a range of data and ways of presenting it that can cater to all needs.

People, process, and technology: introducing digital coordination

How can you overcome these common data challenges and find a solution that helps you turn your ESG strategy into action?

One of the key approaches driving success for our clients is digital coordination. Digital coordination can happen at fund level or asset level – and ideally, the key is to link the two.

Digital coordination ensures that you can:

- Access to your data

- Organise your data in the right format and in the right way

- Communicate your data effectively

- Integrate all your data systems into one

- Speak to your different stakeholders

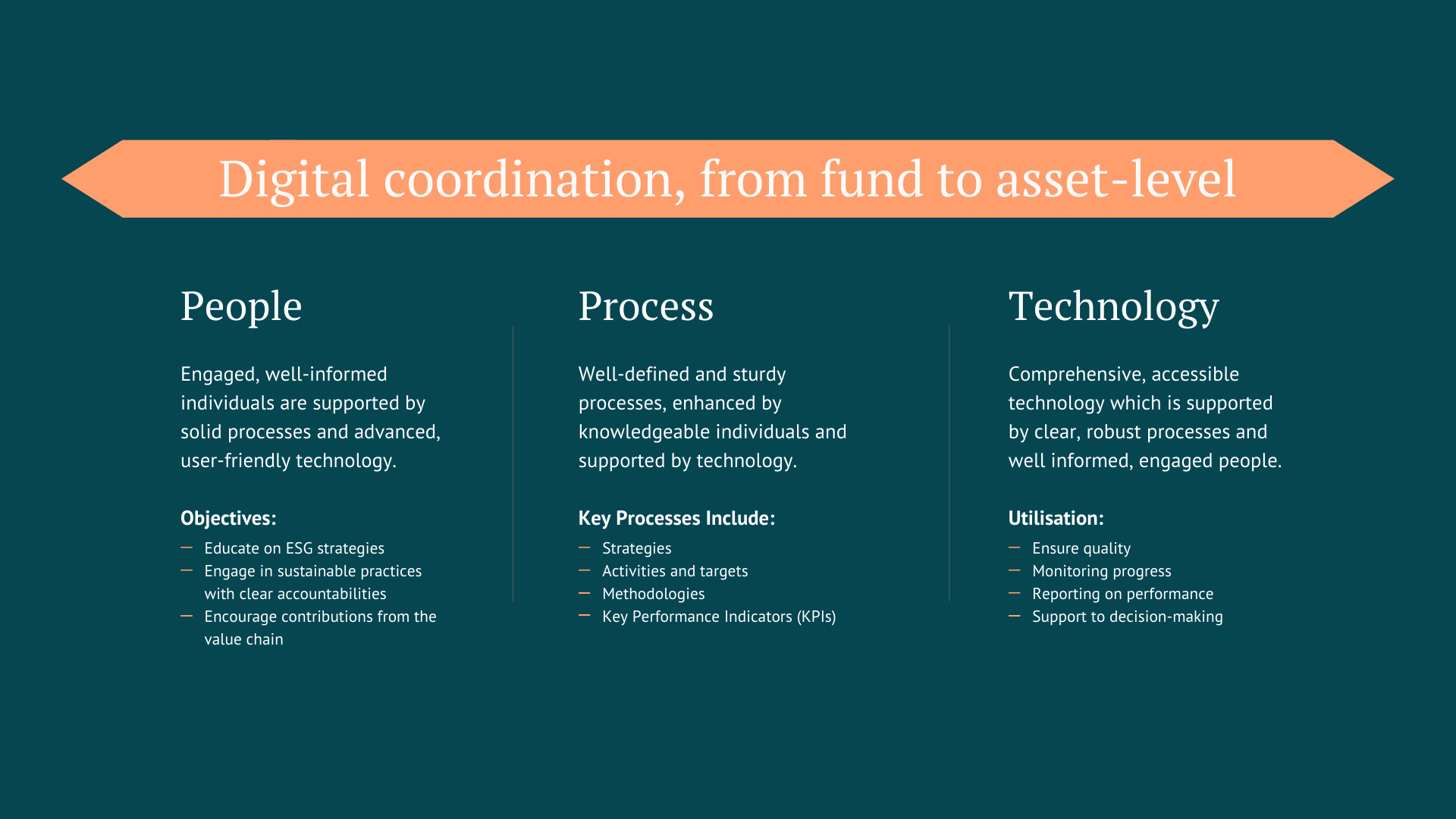

At Catalyst, we use the following framework to break digital coordination down into tangible actions:

This framework is based on three pillars: people, process, and technology. Together, they ensure that you have all the elements in place for successful ESG implementation.

People

To turn your ESG strategy into action, you need engaged, well-informed individuals that are supported by solid processes and advanced user-friendly technology.

To foster this, educate everyone on your project about your ESG strategies and communicate the rationale behind them with different stakeholders. You should also set clear accountabilities so everyone across the value chain knows who’s responsible for what. Finally, for elements outside of your control that nonetheless impact your outcomes—such as tenant behaviour—share the benefits you’re working towards to encourage people to collaborate with and contribute to your ESG goals.

Process

A clearly defined process enhances the performance you’re trying to achieve. To map this out effectively, identify activities and targets, decide which methodologies you’ll use, and set key performance indicators (KPIs) so you can follow up on progress.

Technology

When you’re dealing with a complex environment (for example, a very large value chain or a high volume of assets across multiple geographies and stakeholders), technology is the element that brings everything together, supporting your processes and allowing you to keep people informed and engaged.

Using built-for-purpose ESG reporting software like Obi ensures that you have comprehensive, accessible, high-quality data; that you can monitor progress on what you said you’d do; and that you can report that progress to internal or external stakeholders. It becomes your day-to-day tool to support decision-making, giving you at-a-glance insights about whether you’re on track, need to redirect your actions towards certain elements to meet your goals, or should completely pivot because you’re not getting the right results.

The triptych of resources: efficiency, value, and compliance

Throughout the process, it’s important not to lose sight of why you’re implementing your ESG strategy in the first place. Ultimately, it comes down to the powerful triptych of resource efficiency, value, and compliance. Share this with your value chain and stakeholders to help them understand why it’s so crucial.

1. Resource efficiency

Resource efficiency refers to the operational outcomes that come from implementing your ESG strategy. These are the day-to-day benefits, either for yourself as an investor or for your value chain. For example, if you have commercial assets, resource efficiency makes your product more attractive to tenants, which can increase occupancy rates.

For ESG, resource efficiency involves adopting energy efficiency measures, such as improving energy use in your buildings, managing your waste, and monitoring water use at the asset level. It applies both during construction and the operation of the asset.

Tracking this information at a granular level in your reporting tool lets you understand the performance of your assets in relation to your overall fund and identify strategic initiatives you can undertake to improve them. By monitoring your progress, you can deliver resource efficiencies that lead to higher incomes and increase the availability of capital to fund your assets.

2. Value

Value is what drives most ESG involvement, so naturally you want to ensure your asset’s value is enhanced once you’ve implemented the necessary actions.

There are two ways of seeing value. Defensive CAPEX is about protecting the value of your asset rather than creating additional value. When you have a very wide portfolio of assets, some may be quite old. With new regulations and energy performance expectations, it’s crucial to focus on value protection to ensure your asset doesn’t become obsolete and stranded.

Then there’s the value creation you can generate through the rollout of your ESG strategies. We’ve already looked at resource efficiency and how to position your asset better on a day-to-day basis, but for most investors, the real consideration is the point of sale. This is the moment where the asset’s value will be captured again and you’ll see the benefits coming into your cash flow.

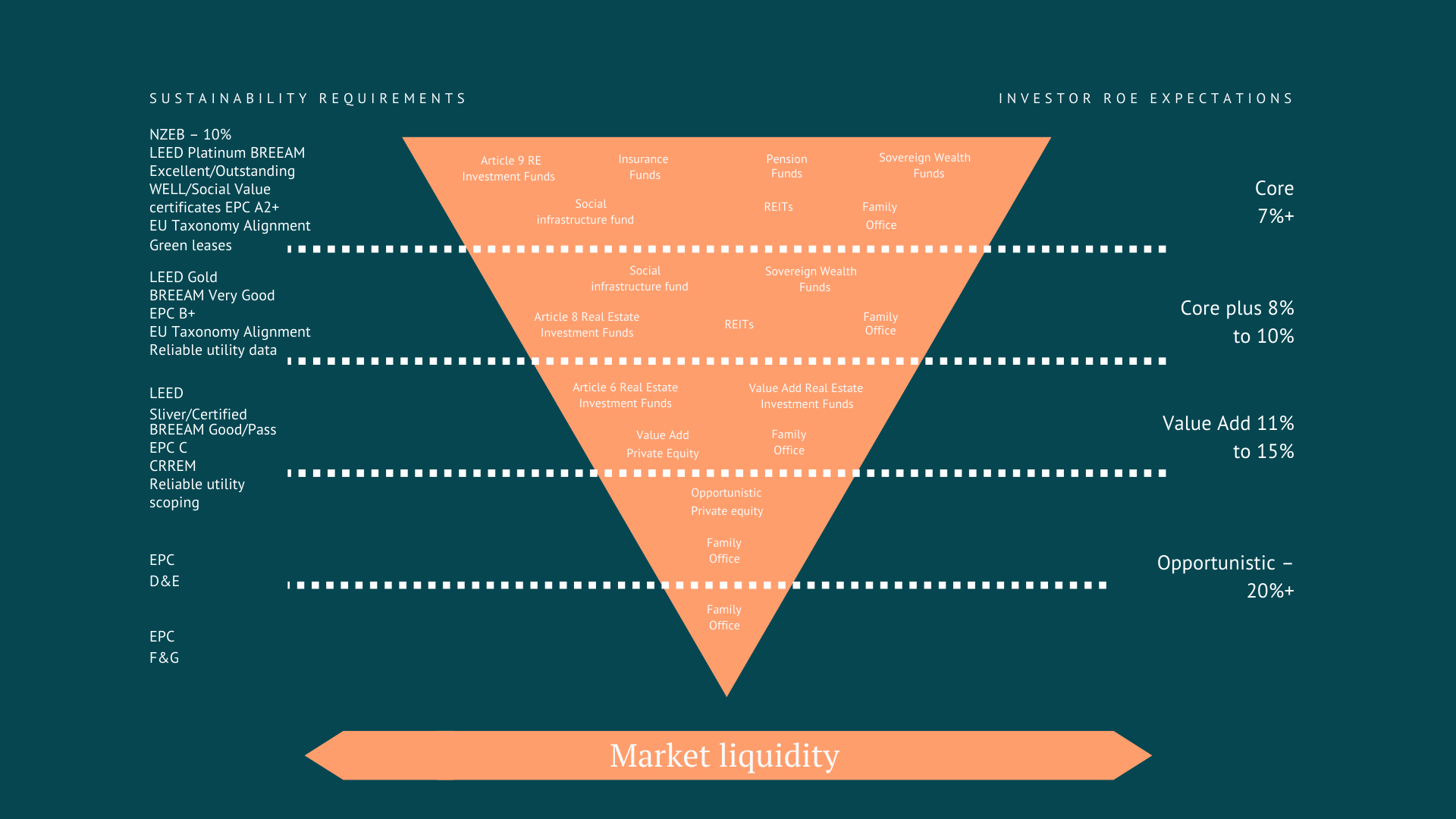

This is why market liquidity is a real driver and focus for our clients. The below graphic shows how market liquidity can be enhanced depending on what sustainability requirements you’re targeting:

In this case, knowing who you’re trying to sell to and working on your exit readiness in advance of the point of sale is key. For example, if you’re targeting a certain type of investor that you know is looking to integrate an asset into an Article 9 SFDR fund, you automatically know that there’s a set of sustainability requirements you need to demonstrate before you can speak to them—which will inform your ESG strategies and KPIs.

The right technology massively streamlines this process, ensuring you have all the data available to submit to potential investors and prove your asset complies with the criteria they’re looking for via a check-list exercise.

3. Compliance

Compliance is essential, but it starts with building solid foundations.

To be compliant, you need to have a reliable set of data that’s undergone quality assurance and can be put into the right format—with the right level of detail—depending on the specific requirements at hand.

As regulations evolve, you may also need to demonstrate additional compliance, such as CSRD. In this case, you’ll need to be able to go back to your data to find and confirm everything, including third-party information and documented-evidence.

Being able to access clear, auditable data and demonstrate compliance is going to become even more essential going forward, especially with regulations and legislations like EU Taxonomy, SFDR, and CSRD.

Demonstrating compliance also has a commercial element to it. We’re seeing that EU Taxonomy is very much a competitive advantage on the markets, as it’s increasingly expected from a lot of investors, particularly institutional investors.

There are also other regulations that we know are going to come into practice like the Energy Performance of Buildings Directive (EPBD), which will require a certain digital data book to be collected at the asset level and be shareable on a specific platform. As part of the ongoing benchmarking process, we expect the classifications of existing assets to change once the EPBD comes into force—so having visibility over the assets in your portfolio right now will put you in a better position to take action when it does.

A powerful ESG platform ensures you have all the data you need to demonstrate compliance today—and tomorrow. It provides a complete oversight of the evidence at your disposal and a comprehensive audit trail that gives you, and independent auditors, full visibility and accountability, so you can quickly respond to emerging requirements and stay compliant.

Transform your ESG strategies into results with a data-driven approach

Having the right data at your disposal is crucial to translating your ESG strategies into action and delivering real-world results. Adopting a digital coordination framework unites your people, processes, and technology to tackle key data challenges, aligning everyone around one centralised source of truth for more transparent, accurate, and effective reporting.

Want to learn how our digital platform, Obi, can help you turn your ESG strategies into action? Book a demo.